Insights

Insuring Self-Storage Conversions: What Agents Should Know

Self-storage conversions are having a moment. If you work with clients planning portfolio expansion, the latest Inside Self-Storage (ISS) article, “Self-Storage Conversion Projects: Benefits, Options and Key Considerations for Success,” is well worth your time. The piece breaks down why conversions are becoming a go-to strategy, where the hidden risks sit, and what developers often underestimate. Below is a top-line summary for agents who want to better support...

Benefits of Working with a Program Administrator

While there’s no silver bullet when it comes to complex, specialty insurance placement, the skills of a Program Administrator come close. Program Administrators leverage their market expertise and industry credibility to guide their agency partners and clients through an insurance landscape fraught with rate increases, capacity restrictions, and...

What You Need to Know About Insuring Sports Memorabilia

The world of sports memorabilia is a treasure trove of history, unforgettable moments, and (in some cases) risky investments that paid off. From legendary game-worn jerseys to iconic trading cards, to championship souvenirs, and more, collectibles ignite a certain type of passion that transcends time. On top of the nostalgia and sentimental value...

How Weather Trends are Affecting Agribusiness

Although each season always has its surprises, shifting weather patterns in recent years have become far less predictable and much more extreme. As a result, the agricultural industry is now navigating an unprecedented swath of challenges. Throughout the United States, sweltering heat waves, raging fires, and winter storms have destroyed crops,...

Doing Business in Extreme Heat: Protecting Employees is the Top Priority

The summer of 2023 is already in the record books, and it’s only at the halfway point. An unprecedented heat wave has held the Northern Hemisphere in its grip for weeks, causing a spike in heat-related injuries and fatalities in many parts of the U.S., disrupting operations for businesses that rely on employees to work outdoors, and calling into...

The Financial Impact of Hailstorms

Nature has a way of reminding us of its immense power, often showcasing its strength through hailstorms and powerful winds. These events can leave us in awe at the raw power of nature, but the aftermath can be devastating, leaving behind a landscape marked by damage and uncertainty. In the midst of the chaos of a severe hailstorm,...

Emerging Challenges for Nonprofit and Social Services Organizations

In today’s ever-changing world, nonprofit and social services organizations play an invaluable role in addressing social, humanitarian, environmental, and other issues with the goal of improving the well-being of individuals and communities. Like any organization, nonprofits face challenges that may impede their ability to continue serving their...

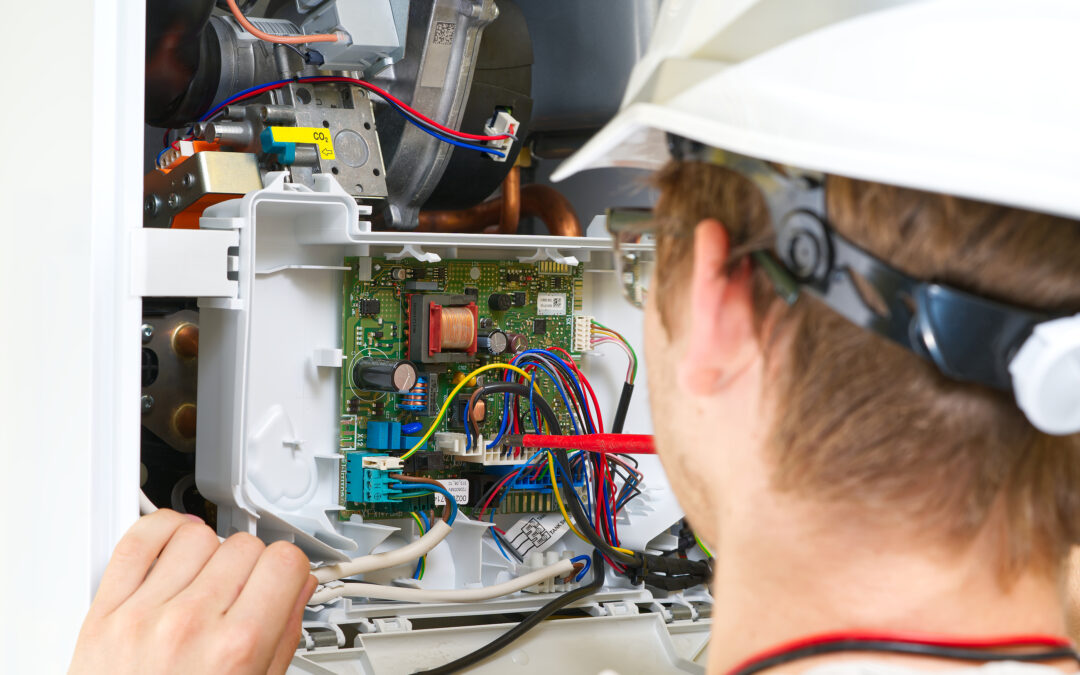

Protect Businesses with Equipment Breakdown Insurance

In today’s fast-paced and technology-driven landscape, businesses rely heavily on a wide range of equipment and machinery to power their operations, streamline processes, drive productivity, and, of course, increase customer satisfaction. Yet, no matter how advanced or reliable a company’s equipment may be, equipment breakdowns can and do occur,...

MiniCo Insurance Agency Named Best of Business in Self-Storage Commercial Insurance for 12th Year

For the 12th consecutive year, MiniCo has claimed the top spot in self-storage commercial insurance. MiniCo Insurance Agency (MiniCo) has been selected by readers of Inside Self-Storage magazine as a Best of Business winner in the category of best commercial insurance for the twelfth consecutive year. MiniCo executive Mike Schofield commented,...

Insuring High-Value Collectibles

There’s investing in stocks, and there’s investing in collectibles. In the latter case, collectors represent a unique group of investors, and it may be precisely this reason why the world of collectibles is as unpredictable as it is adventurous. Some categories of collectibles represent million-dollar investments. Water damage, theft, and even...

King of Collectibles: What Insurance Agents Should Know

“We sell the most interesting things in the world from all categories — sports, entertainment, comics, rock and roll, movies — and we also deal with an incredible cross-section of celebrities, athletes, serious collectors as well as individuals who may find that one thing that’s going to change their life. Literally, within the first 60 seconds...

4 Specialized Insurance Coverages for Self-Storage Businesses

Within the commercial real estate market, the self-storage industry stands out from the crowd. With its seeming immunity to economic fluctuations, the self-storage sector rode out the Great Recession, a global pandemic, and supply-chain disruptions and is currently seeing an upswing in new construction and expansion. Industry newcomers need to be...

Protecting a Collection in the Event of a Hurricane

Billion-dollar weather events are on the rise. As an insurance agent, you are likely counseling clients to review and adjust coverage for their personal homes and commercial properties. But have you asked about their collections of artwork, signed sports memorabilia, wine…or something else? For context, insured losses due to severe weather...

What Agents Should Know When Insuring Horse Boarding Facilities

There’s been a tremendous shift toward recreational horse ownership, so much so that this group represents a significant (and the fastest growing) portion of the horse industry. Accompanying this growth is an increasing need for horse boarding facilities that can provide quality equine custody and care. As the market grows, many owners of horse...

5 Ways to Mitigate Wind and Hail Damage Risks for Your Insureds

Insurance claims for small businesses occur frequently enough; in 2020 alone, 3 out of 4 businesses experienced an event that could have resulted in an insurance claim. With that statistic in mind, it begs the question: “What are the most common claims for businesses?” Recent data indicates that claims resulting from natural disasters rank second...

Cyber security: how to guide your insureds through a data breach

How to Guide Your Insureds Through a Data Breach Whether through sophisticated malware, phishing schemes, or an unsecured website that leads to data leaks, cyber attacks occur frequently enough to warrant due diligence. Cyber attacks affect businesses of every size — from a mom-and-pop shop that takes digital payments to large enterprises that...

Giddy Up Your Coverage: Insuring Bourbon Collections in Time for the Kentucky Derby

Bourbon has become a treasured prize for collectors around the world. But whether you enjoy sipping it neat or mixing it into classic cocktails, bourbon is singularly beloved and wholly American. Bourbon is the only spirit native to the United States and, in fact, is protected by a 1964 Congressional resolution that limits its production to...

Cyber Risks of Using Public Phone-Charging Stations

Your clients’ exposure to cybercrime doesn't end at the office door. Hackers have a variety of ways to access critical business information via phishing, ransomware, and malware. One of the latest trends in cyberattacks involves the use of public phone-charging stations. Although these charging stations are convenient and appear safe, they can...

How to Insure Antiques and Fine Collectibles

It’s a $42,000 mistake that happened recently at an art exhibit in Miami. The most famous balloon dog sculpture in the U.S. was accidentally knocked over by an attendee — and it shattered into pieces. Wait a minute..? Why didn’t they place that sculpture under protective glass or something? Good point! But the bigger question is, “Who’s going to...

PEZ Outlaws, Beanie Babies, and the Need for Insurance

There’s a group of collectibles that deserves to be in its own category. And because the right name for it doesn’t exist yet, we came up with an acronym of our own. We’re calling this group the CCC — short for “collectible cash cows.” You may already know a bit about these high-value collectibles that have become internet sensations. For one,...

MiniCo Announces Sale of its Publishing Division to Storelocal

Phoenix, AZ (March 8, 2023) – MiniCo Insurance Agency LLC (MiniCo) announced today that it has finalized the sale of its Publishing Division, effective March 1, 2023, to Storelocal Media Corporation (Storelocal). “It’s very exciting,” said Travis Morrow, Storelocal’s CEO, “Mini-Storage Messenger is not about just a magazine–it’s what it...

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Stay Informed

Want to receive information from MiniCo on timely marketplace trends, hot new program launches, and valuable industry expertise that will set you up to win? Sign up to receive email communications.