Expert collectibles insurance

Collectors represent a unique group of investors, and it may be precisely this reason why the world of collectibles is as unpredictable as it is adventurous. Some categories of collectibles represent million-dollar investments. Water damage, theft, and even the occasional “Oops, I dropped it” can be significant risk exposures for your client’s collection.

As an insurance agent, you can help your client protect the full appreciated value of their investment with a specialized collectibles insurance policy. Collectors who aren’t aware of this type of monoline coverage may be defaulting to coverage under a standard homeowner’s policy, which is not designed to protect items that are expected to appreciate. High-value collections displayed in a corporate office or other commercial setting also need specific coverage, usually best accessed through a monoline collectibles insurance policy.

Need a Quote Now?

MiniCo’s online portal makes it fast and easy! Get a quote in as little as 60 seconds and bind coverage online.

Our exclusive program offers:

- Carrier rated “A” by AM Best

- $0 deductible and competitive premiums

- Coverage up to $1,000,000 (higher limits available)

- Coverage for full collectible value

- Nationwide availability

- No appraisal required at application for most collectible categories

- No minimum production requirements

- Competitive commissions

Expanded Capacity for Jewelry and Watches

You Asked. We Answered! MiniCo has added an additional carrier partner specifically to address private collections valued up to $10 million.

Target classes include:

- Wine and spirits

- Fine art

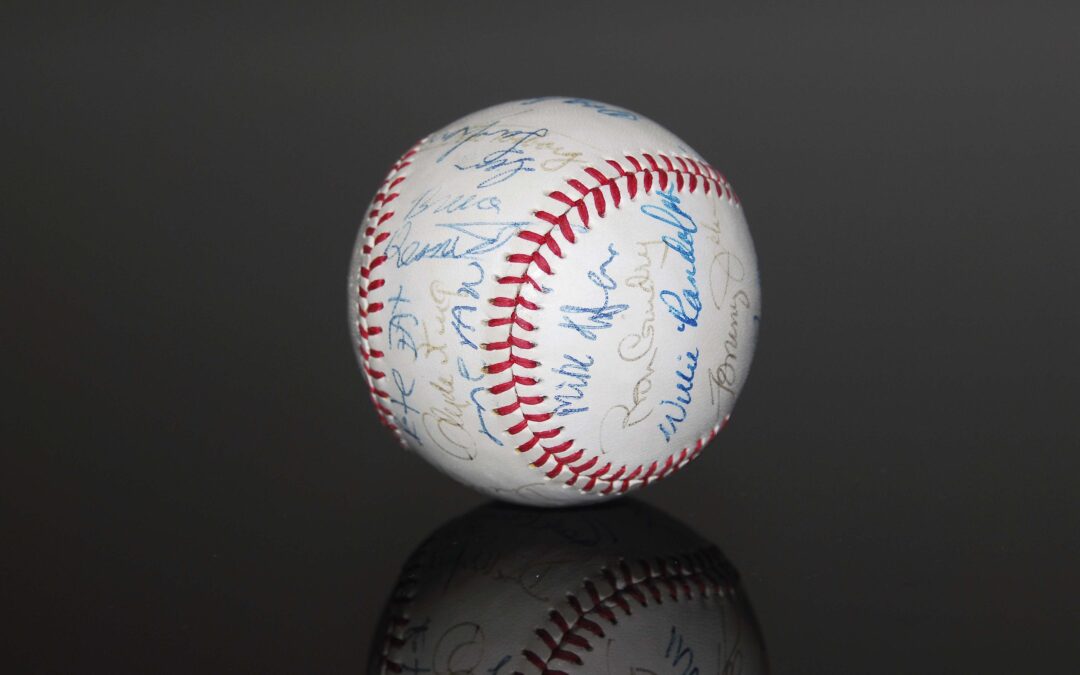

- Sports memorabilia

- Musical instruments

- Clocks, toys, miniatures, and more

Contact James Appleton at james.appleton@minico.com or 800-528-1056, ext. 3532.

Get the MiniCo Collectibles Brochure.

Industry Insights

Want to learn more from our collectibles insurance experts? Explore these valuable resources and enjoy insights from our expert collectibles team.